Building Communities

IF you were asked what Seville, Paris and Claremont have in common, you’d be forgiven for drawing a blank.

For Rory Costelloe, the three were pivotal in shaping his vision for a pirate ship on a massive man-made viewing hill with a giant 35 metre slide, thrilling adults and children alike.

It sits within one of his Melbourne developments, Alamanda, regarded by many as the best playground in western Melbourne.

The Villawood Properties founder and executive director is a collector of innovative ideas and travels widely to draw inspiration for his growing portfolio of communities – 73 of which are completed to date.

“To become a good developer, you need to travel and see what innovative people are doing overseas, bring those ideas back and commercialise them,” Costelloe says.

“I take pictures and say, ‘I’m going to build that’. I look at my photos and visualise to consultants what I want to do.”

Community is the key pillar of Villawood Properties\, with many of the developments designed around everything from parks, cafes, gyms, tennis courts, lounges and playgrounds to social clubs and groups.

“We excel at creating community,” Costelloe says. “We think it’s our job to help people meet each other, so we build these clubs, which centre around the parents’ lounge, and people can see the kids in the pool or playing tennis and can grab a coffee 10 metres away.

“The central motto, for me, is: ‘Make friends, build a community and be proud to call it home’. Most developers focus on how to develop a property to make money; we focus on creating great spaces and communities, and the money follows.”

From Survival To The Top Six

While Villawood Properties today has a dominant presence in residential land development, its beginning was humble.

It began 35 years ago when a small syndicate got together in Bendigo and put in $10,000 each to purchase a piece of land for $150,000, plus stamp duty. The group included Costelloe, who has an engineering background, along with a real estate agent, a lawyer, and an accountant.

Its focus in the early years was surviving the recession, Costelloe says.

A decade later, it moved into the Melbourne market by joining forces with three other syndicates to purchase a 48-lot, $2.6 million property.

“We sold that in 12 months, made over 40% IRR and developed a relationship with Melbourne agents and contractors,” Costelloe says.

From there, Villawood Properties was away and capitalised on a further 25 years of solid property demand.

The syndicate grew and continued to buy more land. It expanded to Queensland and NSW. In recent years, it has moved into South Australia.

Its footprint continues to grow through state government and corporate partnerships, including super funds, such as ISPT and Hostplus.

“The residential land industry is very cyclical,” says Costelloe. “Developers like ourselves are sharper, more nimble and responsive to take opportunities when they occur.

“The ideal partnership to serve our country’s long-term residential delivery needs is reputable, skilled private companies who can deliver new communities coupled with the capital of super funds who share the long-term game plan and are not distracted by cycles.

“We’re a top-six player in Australia now – a national brand. We just bought land in Western Australia, which means we’ll be in all mainland states.”

Since its inception, the company has developed 20,000 lots and it has 26,000 future housing lots currently in the pipeline.

“Over the past 25 years, we have delivered a weighted average IRR of circa 22% to our partners and shareholders,” says Costelloe.

Villawood has developed a following for its community and sustainability focus. It donates two blocks of land to national/state forests for every residential lot sold.

“During COVID-19, the Melbourne greenfields market went from selling 15,000 lots a year, on average, to 29,000 in 2021,” Costelloe says, noting subsequent price rises and responding interest rate rises severely dampened demand in his home state.

“It’s been a real saviour to have a South Australian front as Victorian sales slumped”.

South Australia now provides 40% of Villawood’s weekly sales.

“The South Australian market never got too expensive in the first place, it’s far more affordable. We’ve enjoyed strong sales. It is also pleasing the South Australian Government authorities have far less roadblocks than other states to facilitate development.”

Costelloe says that, apart from the need to reduce interest rates, Australia’s banking watchdog, APRA, needs to cut its 3% home loan serviceability buffer to the pre-Covid-19 level of 2.5% to safeguard the housing sector, help desperate first homebuyers and re-boot the market without adding to inflation.

The Future Of Property

With the ABS forecasting the country’s population will climb as high as 30.8 million by 2032, residential land developers are well positioned to cash in on exploding demand for affordable housing.

The Victorian Government’s strategy to accommodate the burgeoning population includes building public transport-central high-rises in Melbourne.

However, for Costelloe, the sense of community he’s passionate about can’t be replicated in high-rise developments.

“I’m a fan of low-rise living because there’s no community in high-rise.

“Once you get a tall building, you get a lot of lifts. When you go 60 floors in, say, nine lifts, the chance of seeing anybody regularly is minimal; people keep to themselves.”

Costelloe’s other key objections to mass high-rise development include affordability and sustainability, particularly the burden of large owners’ corporation fees.

“It’s about four times the price to build a high-rise building per square metre as it is a suburban house. With a low-rise building, you can build up to six storeys with lightweight timber construction, so you have a happier community and a much lower carbon footprint.”

So, how does Australia accommodate population growth without building vertically? “To me, the solution is greenfield and regional areas,” Costelloe says.

“These areas have far more capacity. People move there to live in a detached house and will drive as far as needed to find it. The Federal Government is addicted to population growth to bolster our GDP, but there must be a balance between immigration and our ability to provide housing for them.”

Costelloe is preparing for what he expects will be a boom in demand for regional living by doing what he says he does best: creating communities people are proud to call home.

“If you create a really good product that the community wants to buy and live in, the profits follow.”

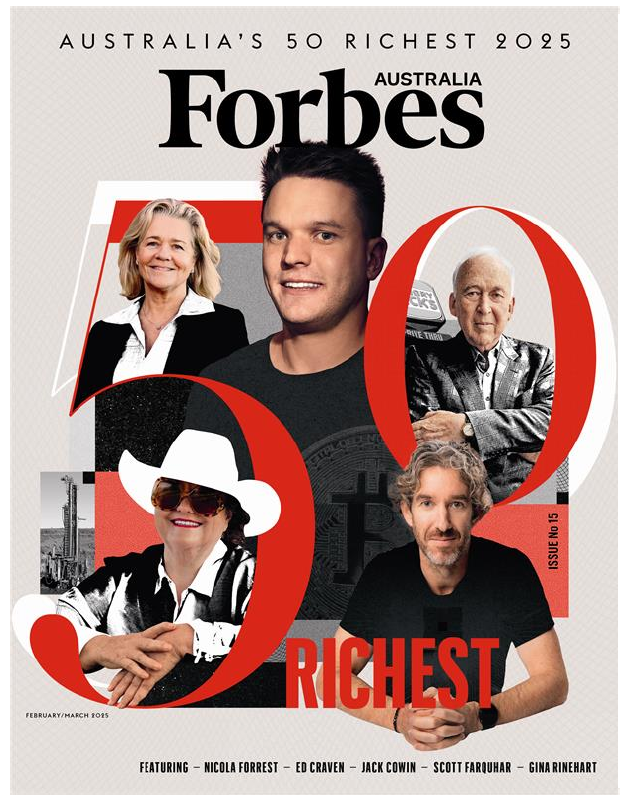

As featured in Forbes Magazine – Feb/March 2025 – Issue No. 15